AML Sanctions Screening

- Home

- AML Sanctions Screening

Real Time AML Sanctions Screening & Entity Resolution

Meet Regulatory Requirements with Advanced AML Sanctions Screening

Helping Financial Institutions meet regulatory requirements for Onboarding, Perpetual KYC, Sanctions screening, and more with the most advanced and accurate persistence automations, Real Time sanctions screening, COP/BAV, Alert Suppression, and more.

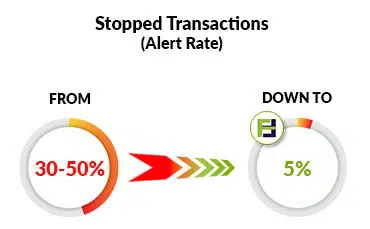

Reduce Operational Costs by up to 90%

Known industry alert rate average is between 30 to 50% due to legacy tech. and inability to screen and match names derived from different languages. This results in huge operational burden. Commercial implementation of Fincom’s AML Sanctions Screening demonstrates reduction of operational costs by up to 90%!

The Technology Behind

Phonetic Fingerprint technology

Fincom’s Phonetic-Linguistic Engine based on Phonetic Fingerprint technology has an exceptional ability to measure the true level of Phonetic Proximity, dramatically reducing alert rate and false positives.

Phonetic Fingerprint is a single mathematical representation of the pronunciation and phonemes of a name (individual or entity). Tracing phonemes across over 44 different languages in original scripts, across various transliterations and spelling variations, enables accurate name matching.

Fincom offers a robust AML screening solution that utilizes advanced technology for accurate name matching. The solution incorporates a powerful Phonetic-Linguistic engine with a phonetic fingerprint core-technology, enabling real-time verification of data across multiple sources and 44 different languages in original alphabets. It successfully resolves different name transliterations, pronunciations, and spelling mistakes and variations.

Based on the Phonetic Fingerprint Technology, Fincom’s solutions are specifically designed to provide a high level of precision and recall rate, while minimizing false negatives (missed hits) The mathematical decision-making mechanism is transparent, traceable, and explainable, aligning with regulatory and operational requirements.

40+ LANGUAGES

in original Alphabets

Overcoming Language boundaries:

Fincom’s phonetic-linguistic engine based on the proprietary Phonetic Fingerprint technology allows for names screening and matching within and across languages, recognizing both names in their language of origin as well as name transliterations. Unique ability to “understand” and match unstructured names in a multilingual environment. Currently the language pool includes over 40 languages in original Alphabets among them: Russian, Chinese, Arabic, Spanish, Korean, and others.

MODERNIZING BANKING TECHNOLOGIES

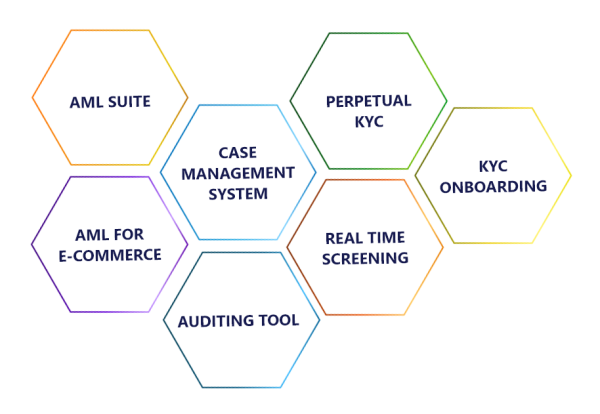

AML SUITE FOR FINANCIAL INSTITUTIONS

Accurate sanction screening across all Payment Rails

Wire | RTP (FedNow) | ACH | SEPA Accommodates specific requirements of each payment method. Managed from one centralized Case Management System.

Onboarding KYC/KYB Sanction & PEP screening

Perpetual KYC/KYB

Fully automated pKYC solution. The ongoing monitoring is performed automatically, screening the entire client’s database against the latest version of sanction or PEP lists without disrupting the usual workflow

Intuitive Case Management System

Manage sanction screening tasks from one centralized Case Management System

Supports multiple teams’ operations with a built-in permissions hierarchy. The system supports task assignments and allocation, alert management, notifications, dashboard, reports, and more. All the important information on each case (alert sources, related resources, and other info) is easily accessible from within the system.

Smart Alert Suppression Mechanism

Further reducing alert rates by additional 50%

Automated Alert Suppression (Persistence) mechanism remembers each past decision, enabling auto-clearance of previously approved entries, while continuously monitoring the approved cases for any change, both in the entity’s data as well as in the sanction lists’ data. Fincom’s Alert Suppression is a highly conservative mechanism that resolves the dangers of the risky practice of whitelisting.

Automated Lists Update

Automatic Ongoing updates of lists’ data are performed by dedicated BOTs on a daily basis, updating either the whole data set or only changes. The update processes are logged and time stamped to allow complete transparency, reporting, and auditing according to regulation requirements.

Traceable & Transparent Audit Trail

for internal & external audit

Supports and explains the decision-making process, providing detailed, easily accessible information and logs on each decision.

Reports

for follow-up, auditing, inspection

Reports include: metrics and query log for each analyst, KPI’s, cases resolved by automation / analyst / status, data sources logs and time stamps.Schedule a Demo!

Please leave your contact information and we will contact you to schedule your demo.